Last Updated on February 6, 2025 by Arif Chowdhury

Ever felt lost in the chaotic world of trading?

Many traders struggle with identifying reliable setups amidst the noise.

What if I told you there’s a powerful tool that can simplify this process?

Enter Elliott Wave Fractals.

I’ve been navigating the Forex waters since 2015, and I can assure you, mastering this concept has transformed my trading game.

Let’s dive in together.

What Are Elliott Wave Fractals?

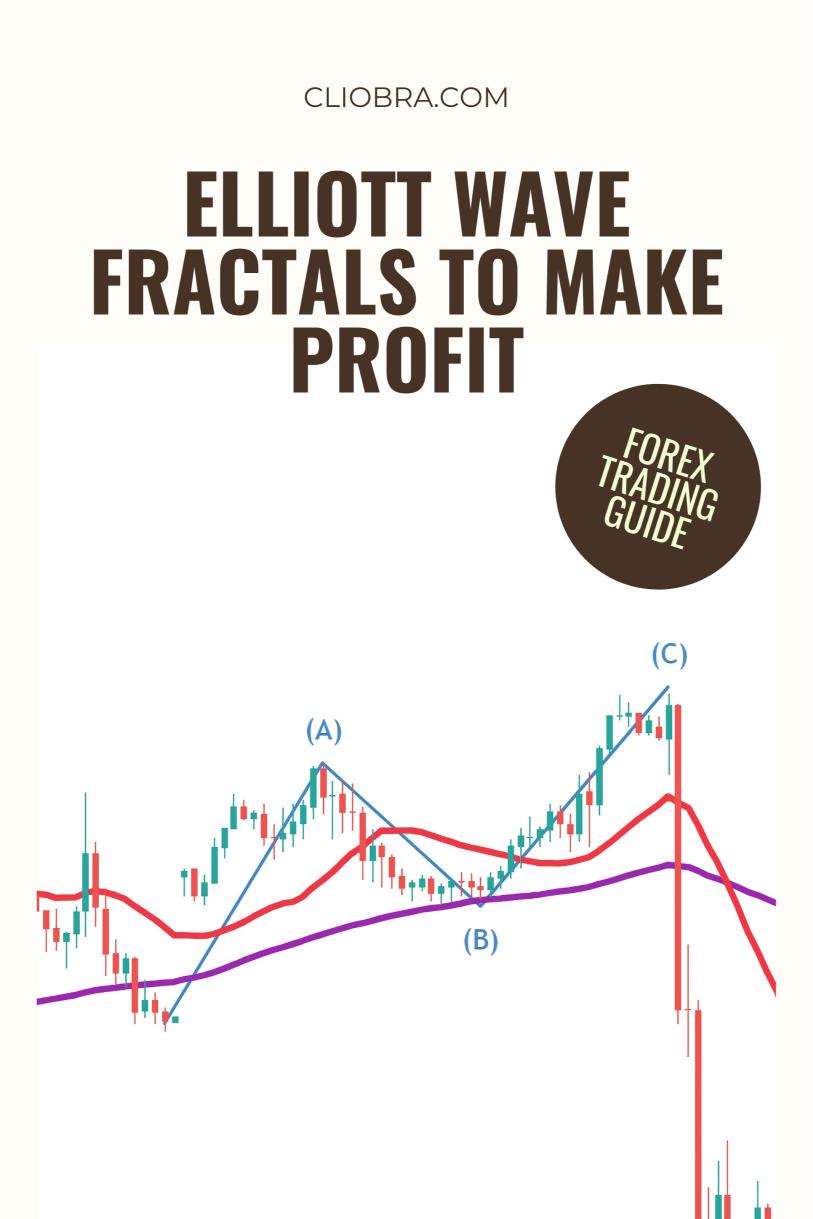

Elliott Wave Theory is based on the idea that market movements follow specific patterns.

Fractals, on the other hand, are recurring patterns that appear at different scales.

When combined, they create a robust framework for predicting price movements.

Here’s how it works:

- Market Psychology: Waves reflect market sentiment.

- Structure: Each wave consists of smaller waves, forming a fractal pattern.

- Predictive Power: Identify potential turning points based on these waves.

Why Use Elliott Wave Fractals?

Let’s look at some compelling reasons:

- Statistical Insight: Studies show that over 70% of traders fail to recognize market patterns.

- Risk Management: Understanding wave structures can help you set tighter stop-loss orders.

- Enhanced Profitability: My personal experience shows consistent profitability when using these tools effectively.

Identifying Trade Setups with Fractals

Now, how do you actually use these waves to spot trade setups?

Here’s a step-by-step approach:

Step 1: Recognize the Wave Structure

Look for the basic Elliott Wave structure:

- Impulse Waves: 5 waves moving in the direction of the trend.

- Corrective Waves: 3 waves moving against the trend.

This structure helps you identify potential entry and exit points.

Step 2: Use Fractals for Confirmation

Fractals are your best friends here.

They help confirm the wave patterns you’re observing.

- Bullish Fractal: A price point higher than the two preceding and two succeeding points.

- Bearish Fractal: A price point lower than the two preceding and two succeeding points.

When a fractal aligns with your Elliott Wave count, you’ve got a stronger setup.

Step 3: Set Your Targets

Once you’ve identified a potential trade:

- Determine your entry point based on the fractal.

- Set a target that aligns with the wave patterns.

- Always use a proper risk-to-reward ratio.

Real-Life Example

Let’s say you’re trading the EUR/USD pair.

You identify an impulse wave followed by a corrective wave.

As the price approaches the end of the corrective wave, you spot a bullish fractal.

This is your signal to enter the trade.

In my experience, this method has consistently resulted in trades yielding 200-350 pips.

Tips for Success

Don’t forget these essential tips:

- Stay Patient: Wait for the right setups.

- Use Multiple Timeframes: Validate your analysis across H4, H1, and M15 charts.

- Backtest Your Strategy: I’ve tested my approach over 20 years, proving its resilience in various market conditions.

Tools to Enhance Your Trading

To elevate your trading experience, consider using the best Forex brokers I’ve thoroughly tested.

These brokers offer tight spreads and exceptional support, essential for any trader.

Check them out here: Most Trusted Forex Brokers.

Additionally, if you’re looking for an edge, my 16 trading bots are designed to trade long-term strategies effectively.

You can explore them here: Forex EA Portfolio.

Conclusion

Using Elliott Wave Fractals to identify trade setups can dramatically improve your trading results.

It’s all about understanding the patterns and applying them effectively.

Remember, consistency is key.

With time and practice, you’ll find that these tools can lead to more informed trading decisions and greater profitability.