Last Updated on January 31, 2025 by Arif Chowdhury

Have you ever entered a trade, excited but unsure how much to risk?

Or felt that knot in your stomach when you realized you might have over-leveraged your position?

Determining the perfect lot size is crucial for successful trading and risk management.

As a seasoned Forex trader since 2015, I’ve learned that getting this right can make all the difference.

Let’s break down how to calculate the perfect lot size for your Forex trades.

Why Lot Size Matters

First, let’s talk about why lot size is important.

Statistically, about 70% of traders lose money, often due to poor risk management.

Getting your lot size right helps you manage risk effectively.

So, what do we mean by lot size?

- Standard Lot: 100,000 units of the base currency.

- Mini Lot: 10,000 units.

- Micro Lot: 1,000 units.

Knowing how to calculate the right lot size ensures you’re not risking too much of your capital on any single trade.

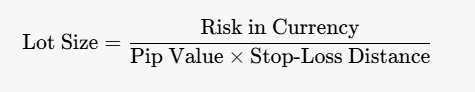

The Formula for Calculating Lot Size

Calculating lot size is straightforward once you know the right formula.

Here’s how to do it:

Determine Your Risk Percentage: Decide how much of your trading capital you’re willing to risk on a single trade. A common rule is to risk no more than 1-2%.

Calculate Your Risk in Currency: Multiply your account balance by your risk percentage. For example, if you have a $10,000 account and you want to risk 1%: 10,000×0.01=100 (your risk in dollars)

Identify the Stop-Loss Distance: Determine how many pips away your stop-loss will be from your entry point. Let’s say you plan to set a stop-loss 50 pips away.

Calculate the Pip Value: The pip value varies depending on the currency pair. For most pairs, the standard pip value for a standard lot is $10, for a mini lot is $1, and for a micro lot is $0.10.

Calculate Lot Size: Use this formula:

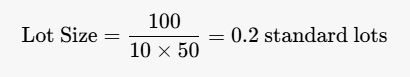

Continuing our example:

Example in Action

Let’s make this real with a quick story.

A few months ago, I entered a trade on EUR/USD.

I calculated my risk based on a 1% rule and set my stop-loss 30 pips away.

Using the formula, I discovered I could safely use a mini lot.

That trade went well, and I was able to lock in profits without over-leveraging.

This is how you build confidence while trading!

Tips for Managing Lot Size

- Adjust for Volatility: If the market is particularly volatile, consider reducing your lot size to account for increased risk.

- Use a Trading Journal: Keep track of your trades, including lot sizes and outcomes. This helps identify patterns and improve your strategy over time.

- Reassess Regularly: As your account balance changes, adjust your lot size calculations accordingly.

The Role of Automated Bots

If you find calculating lot sizes and managing trades overwhelming, consider using automated trading bots.

I’ve developed 15 sophisticated trading bots that handle lot size calculations for you, trading across major currency pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

These bots are designed for long-term success, targeting 200-350 pips and minimizing correlated losses.

Having bots manage this aspect of trading can take a lot of pressure off you, allowing you to focus on strategy and market analysis.

Finding the Right Broker

Choosing the right broker can also impact your ability to manage lot sizes effectively.

- Look for Flexibility: Some brokers allow fractional lot sizes, which can be beneficial for precise risk management.

- Good Trading Platform: Ensure your broker’s platform lets you easily set stop-losses and calculate pip values.

I’ve tested several brokers and can recommend ones that align with disciplined trading practices.

Final Thoughts

Calculating the perfect lot size for your Forex trades is crucial for risk management and long-term success.

By applying the formulas and tips shared here, you can trade more confidently and avoid the pitfalls many traders face.

If you’re looking to simplify your trading experience, check out my 15 trading bots.

They’re designed to help you navigate the Forex market with ease and precision.