Last Updated on November 1, 2025 by Arif Chowdhury

Ever felt lost in the Forex market?

You’re not alone.

With countless strategies out there, it’s tough to know what really works.

I’ve been trading Forex since 2015, and let me tell you, I’ve seen it all.

From gut-wrenching losses to exhilarating wins, I’ve honed my craft through trial and error.

Today, I’m sharing my top 5 Forex trading strategies that have consistently brought me success.

Let’s dive in! 🌊

1. Trend Following Strategy 📈

This strategy is as classic as they come, but it works.

Here’s the deal:

- Identify the Trend: Use moving averages (like the 50 or 200-day) to spot the trend direction.

- Trade with the Trend: Buy in an uptrend, sell in a downtrend.

- Set Stop Losses: Protect your capital by limiting your losses.

The beauty of trend following?

It’s simple and effective.

Statistics show that about 70% of traders fail because they go against the trend, so don’t be that trader.

2. Breakout Strategy 🚀

Breakouts are exciting.

They can lead to significant price movements.

Here’s how to nail it:

- Identify Key Levels: Look for support and resistance levels.

- Wait for the Breakout: Enter once the price breaks through these levels.

- Confirm with Volume: Higher trading volume can confirm the breakout.

Why does this work?

When price breaks out, it often continues in that direction due to momentum.

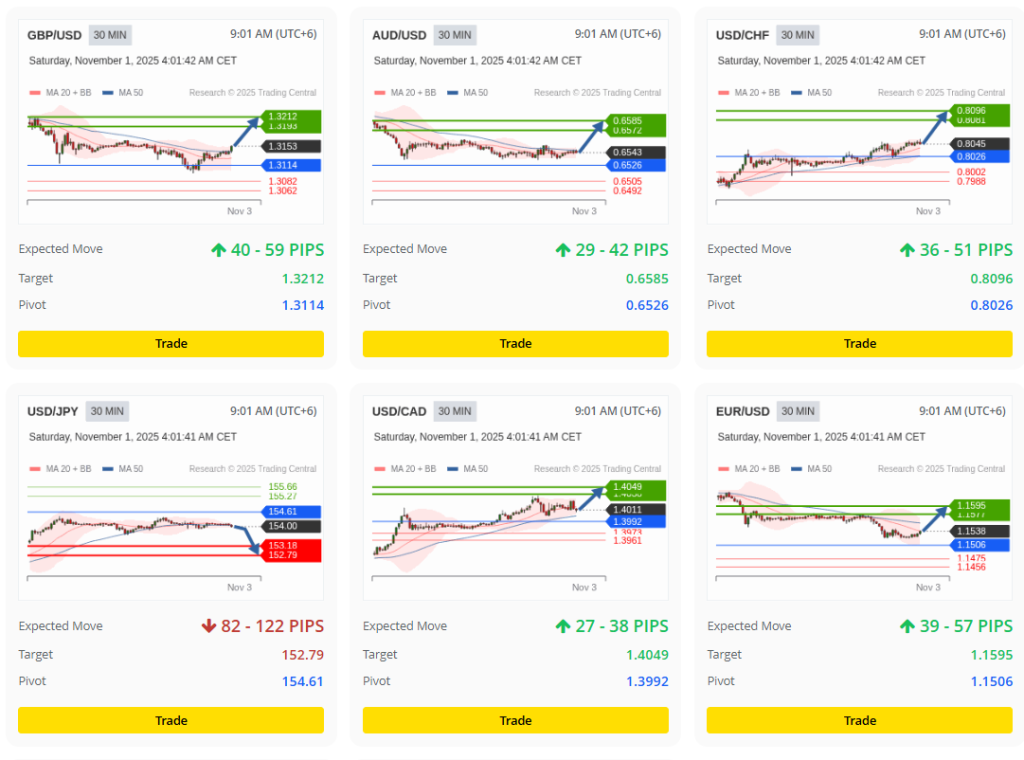

This strategy is a favorite of mine, especially for the EUR/USD pair.

3. Scalping Strategy 🏃♂️

If fast-paced trading is your game, scalping might be for you.

This strategy involves:

- Quick Trades: Enter and exit positions within minutes.

- Small Profits: Aim for small gains on each trade, but do it often.

- High Volume: You’ll need a broker with low spreads and fast execution.

Scalping isn’t for the faint-hearted, but done right, it can lead to consistent profits.

I’ve seen traders make up to 10% a day using this method.

4. Swing Trading Strategy 🐦

Swing trading is perfect if you don’t want to be glued to your screen all day.

Here’s what you need to know:

- Hold Positions for Days: Capture short to medium-term price moves.

- Use Technical Analysis: Look for patterns and signals to enter trades.

- Risk Management: Always use stop-losses to protect against big swings.

This strategy allows you to maintain a healthy work-life balance while still making profits.

I often use swing trading on GBP/USD.

5. Fundamental Analysis Strategy 📊

Don’t just focus on charts; pay attention to the news too!

Here’s how:

- Stay Informed: Keep an eye on economic indicators and news events (like interest rate changes).

- Market Sentiment: Understand how news affects market sentiment and price movement.

- Combine with Technicals: Use technical analysis to time your trades better.

Fundamental analysis can provide a solid edge, especially around major news events.

Did you know that 80% of Forex moves are driven by economic news?

By being aware, you can position yourself ahead of the market.

Note: I have developed 16 diversified trading EAs on major currency pairs. Watch the video to learn more.

🚀Gain 2-5% daily ROI – Get this EA for FREE!

Conclusion

There you have it—the top 5 Forex trading strategies that actually work.

Remember:

- Stick to your plan.

- Manage your risk.

- Continuously learn and adapt.

As I mentioned earlier, I’ve created a portfolio of 16 sophisticated trading bots across major currency pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

These bots are designed to diversify your risk while maximizing your potential returns.

If you’re serious about Forex, consider adding automated trading to your arsenal.

Building a robust and resilient system can significantly enhance your profitability while minimizing risk.

Let’s conquer this Forex market together! 🌟